Vulture Investing. Why two guys are betting

$200 million on housing

Late in 2005, developer Peter Wells was in Tucson, Ariz., ready to begin selling units in a condominium with his partner Marcel Arsenault. He didn't have to do much selling: people were camped in front of the condo office, begging to buy. It was a sign from the real estate gods, says Wells: "We started selling everything." Not only did the pair unload their real estate portfolio; they also began betting against anything real-estate-related. They shorted homebuilders and mortgage companies. Then they took their money and skedaddled as the housing market collapsed.

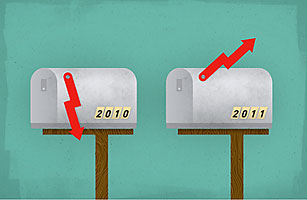

The news on housing in 2011 doesn't seem to be improving. In February, new-home sales tumbled 28% from the prior year. The S&P/Case-Shiller Home Price Index showed prices were still falling in January. "The housing-market recession is not yet over, and none of the statistics are indicating any form of sustained recovery," said S&P's David Blitzer.

Why, then, are Wells and Arsenault, who operate a company called Real Capital Solutions, buying properties like it's 2004? They've bought into nine deals in Miami, a center of oversupply. They've scooped up homebuilders in Denver. "We think there's a bottom happening," says Arsenault, a Ph.D. candidate in molecular biology until entrepreneurialism intervened in 1972 — which is to say that he is research-driven. Arsenault has done the math on housing prices around the world since the 1920s and says that repeating patterns of collapse and recovery offer hope for home buyers, if they have a long-term perspective.

Part of their optimism stems from hardheaded realism. They have been buying "broken" condominium projects — those so far underwater, there's no hope of recovery — and then repricing. For instance, they bought the bank note at a steep discount on a property called the Ascent, a 49-unit condo near the Beaver Creek ski resort in Colorado, and foreclosed on it. They sold 26 units in three weeks — at 50% to 67% off the 2008 prices. It's vulture investing that doesn't thrill developers who are still trying to hold on to delusional precollapse prices, but it's part of the clearing process.

Beyond opportunism, Arsenault says key indicators have turned positive for housing. On the demand side, initial unemployment claims have dropped below 388,000, a leading indicator of job growth, suggesting that foreclosures will decline. The rent-or-buy pendulum has swung in buy's direction because home prices have crashed while interest rates have remained low. The percentage of banks that are tightening their residential-lending standards has decreased.

On the supply side, the pair look at a 50-year trend line in the growth of housing stock, which, on average, has increased 1.1% annually. Supply started to go above trend in 1997 and went off the charts in 2006. Now, with new homebuilding stalled, the trend has reversed. "In our view, 76.7% of the 2.8 million oversupply of housing inventory has burned off," says Arsenault.

Of course, people who bought in Las Vegas in 2006 won't be helped by a modest turnaround. But trying to time the market perfectly isn't the point. Wells and Arsenault are more concerned with getting the direction right. They've concluded that in the next five years, you are going to be better off being long on housing than being short. There will be laggard markets, like Phoenix and Vegas, and buyers need to look at comp sales, volume, days on the market and other microindicators.

If Wells and Arsenault sound like real estate hustlers, they plead guilty. "I am trying to get people to buy," Arsenault admits, "but I'm buying a hell of a lot more than I'm selling. I'm selling homes one-off, at $200,000 each, and buying $200 million worth of projects." In other words, he's got way more house than you do. If he's wrong, it won't be by a little.